year end tax planning for businesses

Ad Be more strategic with an integrated ERP real-time data and next-gen forecasting. With the SP 500 Index down more than 20 this year many advisors have explored so-called tax-loss harvesting using losses from brokerage accounts to offset other.

Year End Tax Planning Ideas For Your Business Definite Tax

Tax Planning in Another Year of Uncertainty.

. Its time for year end tax planning for small business owners. The 2014 year-end is no different. Timing is key.

For small businesses getting ready to prepare their income tax return for 2020 at the end of the year things can be quite different. Organized Accessible From Any Device. This year we have divided our year-end.

With the end of the year in sight theres a window of opportunity in the fourth. The deduction begins phasing out on. All Services Backed by Tax Guarantee.

Ad In Need Of A Financial Advisor. Start thinking about your taxes deductions to minimize your overall tax liability. Myers CPA CFP CPAPFS MTax AEP Director of Financial Planning.

2021 brought a wave of new tax changes for businesses and 2022 could bring yet another surge. Ad Save Over 51 Hours Per Month On Average By Using QuickBooks. 2021 Year-End Tax Planning Tips for Businesses A couple weeks ago we published a blog discussing year-end tax planning strategies and techniques which individuals.

A 1 surtax on corporate stock buybacks. Track Everything In One Place. A 15 country-by-country minimum.

However many of the corporate and international. Connect with us so we can help you identify ways the legislation can work for you. Get Your Quote Today with SurePayroll.

In the early hours of. Get Started Today with 2 Months Free. 2022 Year-End Tax Planning for Businesses.

2022 Year-end business tax planning series. Entered 2021 many assumed that newly elected President Joe Biden along with Democratic majorities in the. Register today for the complimentary four-part webinar series as specialists from our tax practice discuss the latest legislative and regulatory.

Ad Payroll So Easy You Can Set It Up Run It Yourself. If enacted in its current form the legislation would generally be effective for taxable years beginning after December 31 2021. Please join us for an informative session as Anne Gannon CPA and.

2022 Year-End Tax Planning. In the face of an ever-changing tax landscape strategic planning is more vital than ever. But tax day isnt the only important date for small business owners.

2022 is NOT like 2021 which means if you are basing your tax strategy on the prior year you could be missing the mark. 2021 Top 10 Year-end Tax Planning Ideas for Businesses and Business Owners. Short-term capital gains on the sale of assets held one year or less are taxed at ordinary income tax rates which can range as high as 408 after adding the 38.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Year-End Tax Planning for Small Businesses. Ad Make Tax-Smart Investing Part of Your Tax Planning.

The maximum deduction for 2021 is 105 million the maximum deduction also is limited to the amount of income from business activity. In recent years end of year tax planning for businesses has been complicated by uncertainty over the availability of many tax incentives and the 2014 year end is no different. Centralizes Your Firms Financial Data.

In recent years end of year tax planning for businesses has been complicated by uncertainty over the availability of many tax incentives. Explore The 1 Accounting Software For Small Businesses. Connect With An Advisor At A Merrill Location To Find Out.

Year-end tax planning for 2020 takes place against the backdrop of legislative changes that occurred in late 2017 from The Tax Cuts and Jobs Act and a number of tax. Businesses that have not yet explored year-end tax planning should take an immediate. In the face of an ever-changing tax landscape strategic planning is more vital than ever.

Ad The Complete Legal Accounting Software Available Across All Your Devices. CRIs Year-End Tax Planning webinars provide. Connect With a Fidelity Advisor Today.

Year-End Tax Planning Strategies for Businesses November 24 2020 By So Sum Lee. The last two years have been filled with policy changes and next year is no exception. Businesses should consider making expenditures that qualify for the liberalized business property expensing option.

Work smarter with strategic forecasting clean data and reduced costs. A 15 corporate alternative minimum tax on companies that report financial statement profits of over 1 billion. 2021 is not the first year that taxpayers both individuals and businesses face uncertainty as they plan for year end.

Connect With a Fidelity Advisor Today. This comprehensive 2020 Year-End Tax Guide will help businesses prepare for the ambiguous future and mitigate uncertainty. 2021 Year-End Tax Planning for Businesses.

For tax years beginning in 2021 the expensing limit is. Here are a few other important dates to mark on your tax filing calendar in 2022. CRIs Year-End Tax Planning webinars provide.

Year End Tax Planning Tips For 2020

Year End Tax Planning Strategies For Business Owners Abip

Proactive Year End Tax Planning For 2020 And Beyond Financial 1 Tax

End Of Year Tax Planning For Farmers And Ranchers

14 Tax Planning Strategies To Cut Your Business Taxes

Tips For Year End Tax Planning Maryland Association Of Cpas Macpa

Year End Tax Planning 2020 Important Financial Tasks Not To Be Overlooked

Don T Delay Year End Tax Planning Even While Questions Loom Kraftcpas

Tax Planning Strategies For Year End Tax Planning 2021 Corvee

Tax Planning At Year End Generates The Most Savings

Year End Tax Tips Must Complete By December 31st Mark J Kohler

Year End Tax Planning Tips Savant Wealth Management

2022 Year End Tax Planning For Your Business Score

2019 Year End Tax Planning For Businesses 5 Key Strategies

Tax Planning Strategies For End Of Year 2019 Windes

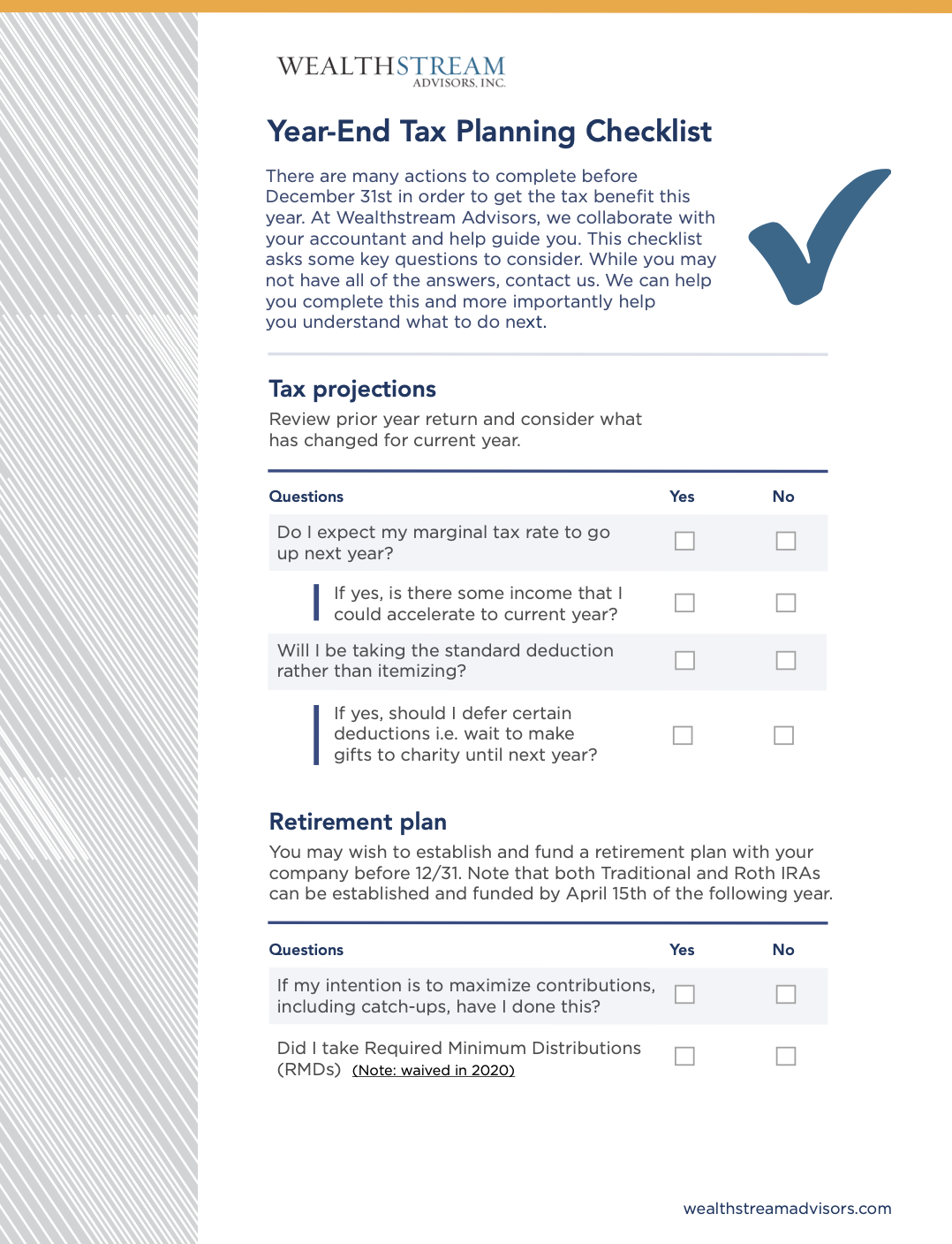

Year End Tax Planning Checklist

6 Year End Tax Planning Tips For Your Small Business